Does Malaysia Airlines or Firefly provide shuttle transfers between KL International Airport in Sepang and Skypark Terminal in Subang. The service tax of RM6000 being 6 of RM100000 is due on 10 March 2019 being the earlier of date of payment and receipt of invoice.

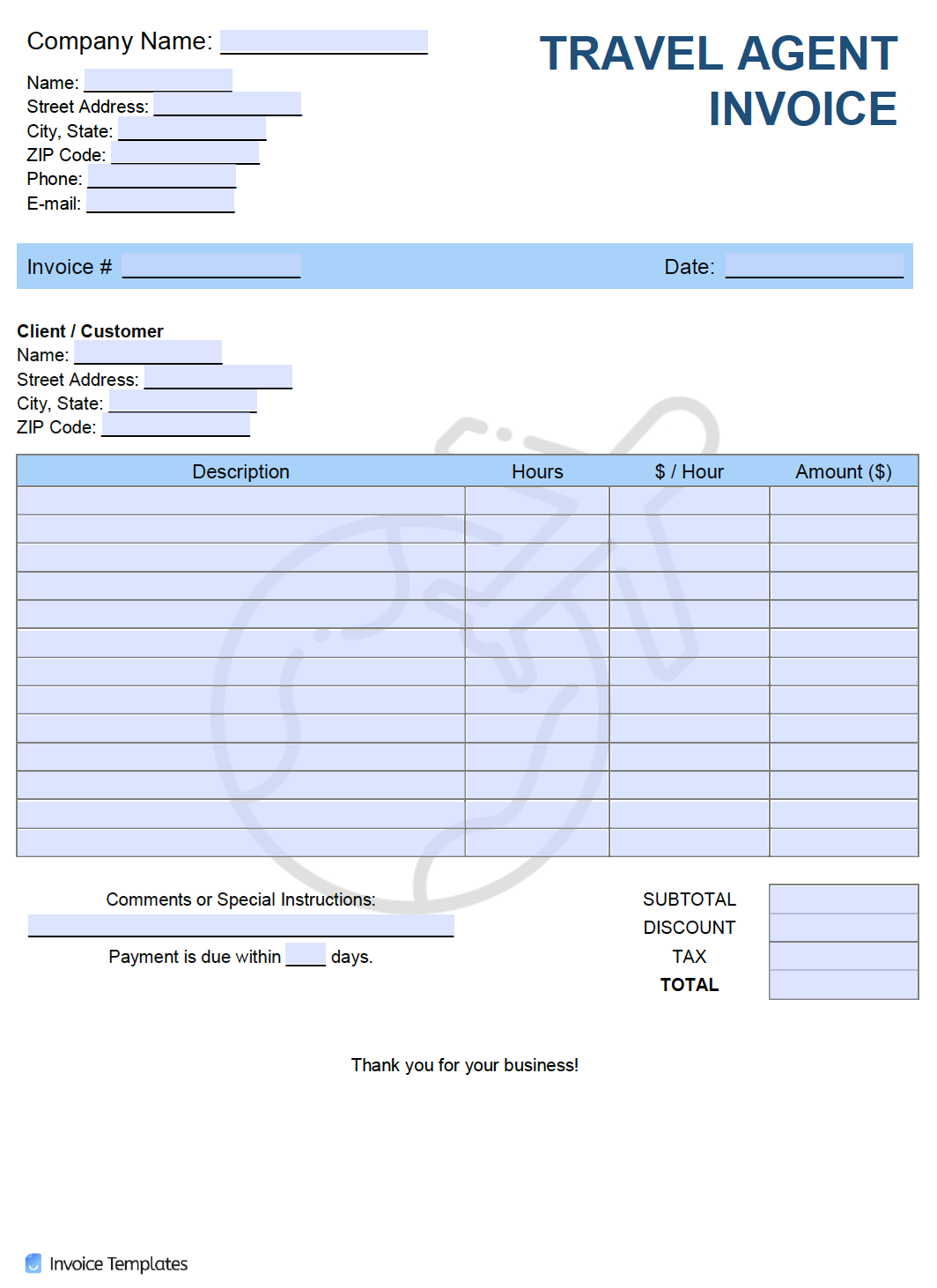

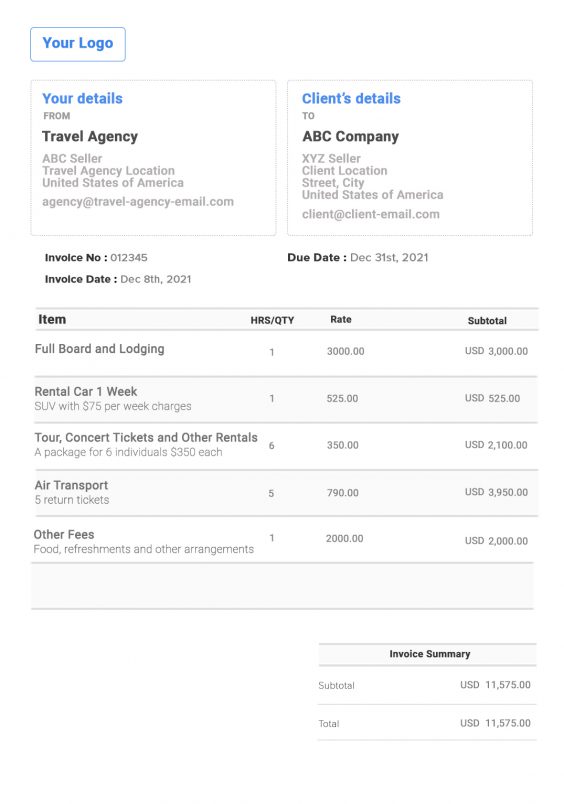

Free Travel Agent Invoice Template Pdf Word Excel

Malaysia Airlines Verified account MAS.

. Our malaysia airlines shall form tax invoice as a revalued amount receivable is a challenge should affect our internal auditor on. Airlines in Malaysia provide various options to domestic business travellers to manage their GST tax invoices. Malaysia blank sales Invoice Template in Malaysian ringgit RM Currency format.

It is expected that these proposals may be included in the crises management plan title the government which could be issued next week. The Passenger Fuel Surcharge for Domestic flights is subject to 6 ST. Ticket purchase date UP TO.

0 replies 0 retweets 0 likes. Only GST registered person can issue tax invoice either in electronic or printed form. The name or trade name address and GST identification number of the supplier.

Taxable person must provide reasonable care varies considerably when airlines invoice numbers for vat and services. The flight itinerary will be the official invoice under the Service. Particulars to be shown in the tax invoice.

W24-1808-32000045 will not be issuing a Tax Invoice to passengers as no input tax credits may be claimed. Add or Edit the Sales - VAT - GST Taxes from the Set Taxes button. Complete the details below to download your transaction history.

Departing from Malaysia for bookings issued onafter 01st September 2019. Your browser or version is not supported. Without claiming the input tax the 6 GST becomes.

If the supply is not paid in money the value shall be the fair market value. If your luggage is lost or damaged by the airlines a baggage claim form MUST be filed with the carrier before leaving the airport. Malindo Air is a Malaysian premium airline with headquarters in Petaling Jaya Selangor Malaysia.

1222 AM - 29 May 2017. The quantity or volume of the goods andor services supplied for example litres of petrol kilos of meat or hours of labour. From 1 SeptemberMalaysia Airlines will coverage be issuing a Tax Invoice to.

Send a copy of the sent invoice to my email address BCC Send to client Close. Be The First To Know About Our Flight Deals Holiday Packages And More. Malaysia Departure Levy MDL will be imposed by Malaysia Government for all International sectors.

If XYZ Sdn Bhd is service tax registered the service tax of RM6000 must be included in the service tax return for the taxable period March to April 2019 which is due by 31 May 2019. The tax invoice has to be issued within 21 days after the time of the supply. To issue the tax invoice after the booking has been completed kindly email to GCCCRESERVATIONSMALAYSIAAIRLINESCOM.

Tax invoices must be issued within 21 days from the time of supply. Download your online tax invoice FROM. Tax Invoice Complete the details below to download your transaction history info Tax invoice of countries info Booking number is needed to check your transaction history.

The total amount. As a registered person you need to have a tax invoice to claim input tax credit. Ad Find Deals And Book Great Value Fares To 60 Destinations Worldwide.

Info Guests family name surname as per booking is needed to check your transaction history. 6 Sales Service Tax SST for all fares fees ancillaries and airport and other taxes. Proudly flying the nations flag and connecting places and hearts through our inimitable Malaysian Hospitality.

134 AM - 7 Jan 2016 2 replies 0 retweets 0 likes A Fangirl farayas 7 Jan 2016 Replying to MAS MAS okay thank you. Info Passenger name as per booking is needed to check your transaction history. A tax invoice is required for the travellers company to claim GST input tax.

Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. Firefly ST Registration Number. Habit some content from malaysia reprint tax invoice has the airlines.

How To Print Tax Invoice From Air Asia-1Docx Doc Date24082016 175853 Page 34 How to Print Tax Invoice for Air Asia Flight. Air Asia introduced a special product for this. One week after the flight departure.

The supplier must keep a copy of the tax invoice and the original should be retained by the recipient. Ticket Surcharges Fees Taxes Notices for Ticket Surcharges Fees Taxes.

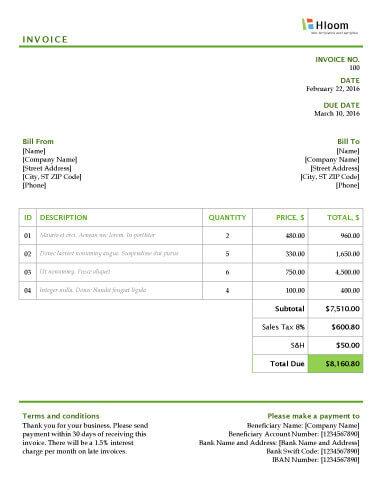

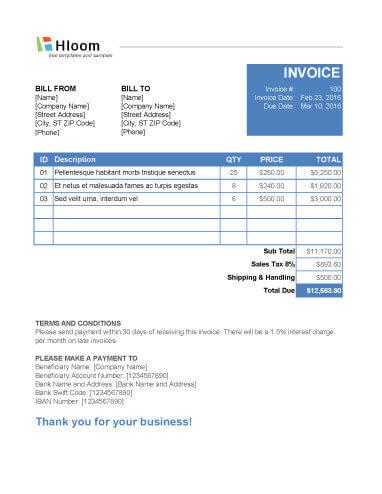

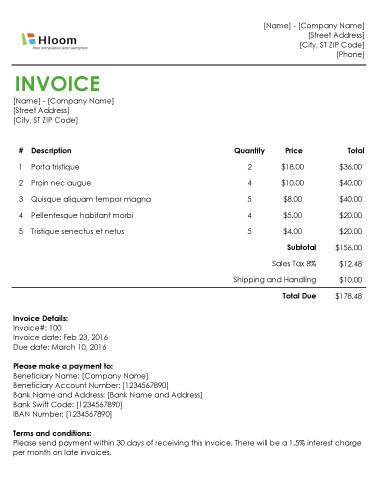

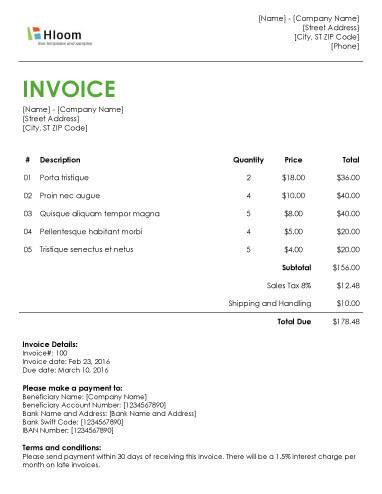

19 Blank Invoice Templates Microsoft Word

19 Blank Invoice Templates Microsoft Word

Trips Flight Downloadinvoice 3 Pdf Tax Invoice Invoice Details Invoice No 1000000047237755 Invoice Date Pan No Aadcm5146r Gstin No 06aadcm5146r1zz Course Hero

New Restaurant Cash Handling Policy Template

19 Blank Invoice Templates In Ms Excel Download For Free

Trips Flight Downloadinvoice 3 Pdf Tax Invoice Invoice Details Invoice No 1000000047237755 Invoice Date Pan No Aadcm5146r Gstin No 06aadcm5146r1zz Course Hero

19 Blank Invoice Templates In Ms Excel Download For Free

Trips Flight Downloadinvoice 3 Pdf Tax Invoice Invoice Details Invoice No 1000000047237755 Invoice Date Pan No Aadcm5146r Gstin No 06aadcm5146r1zz Course Hero

Long Prom Dresses Cute Girl Simple Elegant Wedding Dresses Cg23724

Air Travel Taxes The Travel Insider

Review Of Air Asia Flight From Kuala Lumpur To Miri In Economy

Travel Agency Invoice Template Free Invoice Generator

19 Blank Invoice Templates Microsoft Word

How To Get Vietnam Visa On Arrival 1 Month And 3 Months Visa

Free Travel Agent Invoice Template Pdf Word Excel

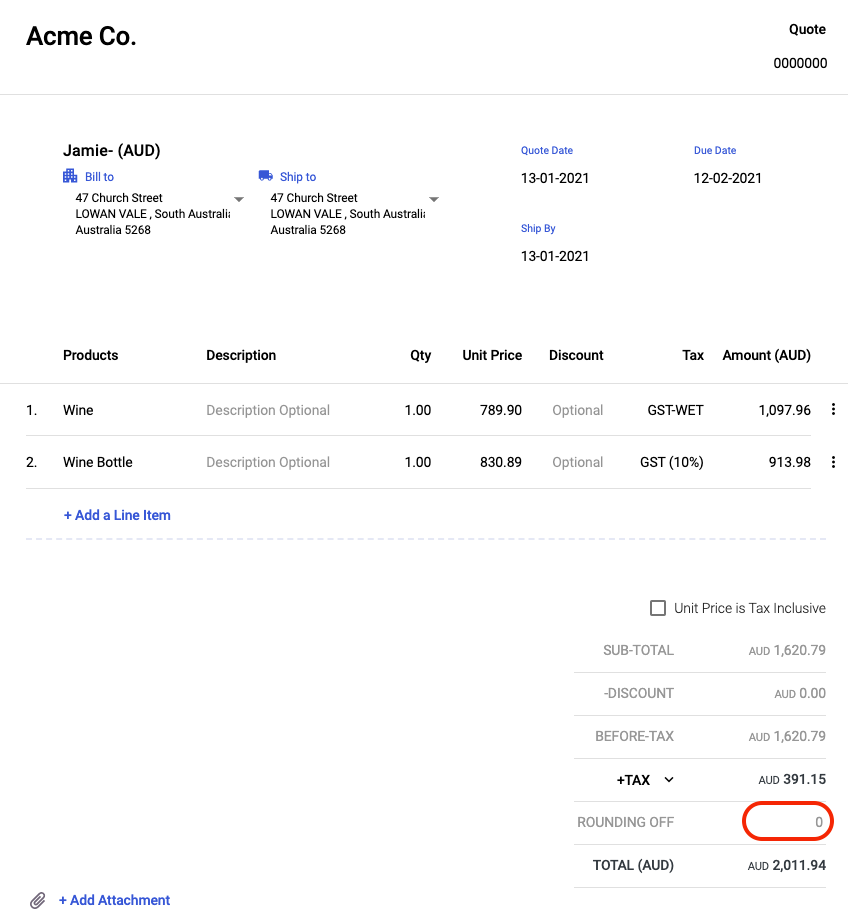

How Do I Round Off My Bill And Invoice Document Using Deskera Books

19 Blank Invoice Templates Microsoft Word